Roe pleased with passage of ‘Tax Cuts’ and ‘Jobs Act’

Published 5:22 pm Friday, November 17, 2017

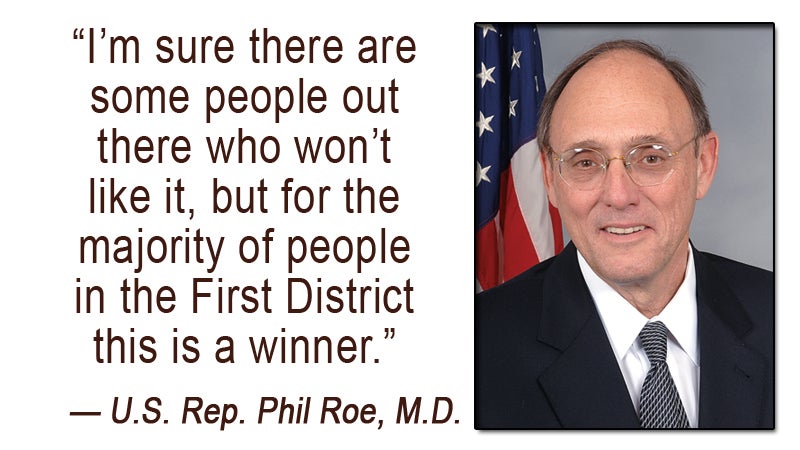

Members of the U.S. House of Representatives passed the Tax Cuts and Jobs Act on Thursday, and one local lawmaker feels the bill will benefit many in Northeast Tennessee.

“I’ve looked at the data that the Chamber provided us for the First Congressional District of Tennessee,” U.S. Rep. Phil Roe said. “This tax bill on the individual side, not the business side but the individual side, really helps the First Congressional District.”

Roe touted the bill’s doubling of the standard deduction as one of the measures that will help the majority of his constituents.

Currently, around 43,000 taxpayers in the First Congressional District itemize their tax returns. By increasing the standard deduction and simplifying the forms, Roe said tax preparation could become easier for an estimated 80 to 90 percent of the First Congressional District.

“It’s estimated that nine out of ten Americans will be able to file their taxes on a form as simple as a post card under this legislation,” Roe said. “This bill represents the kind of tax reform Tennessee families deserve, and I’m glad the bill passed the House today.”

Another aspect that will aid taxpayers, Roe said, is an increase to the child tax credit for families.

“This bill will help Tennesseans keep more of their pay and relieve the stress that comes with filing taxes and navigating a bloated, complicated tax code,” Roe said. “Under the Tax Cuts and Jobs Act, a family of four making $58,367 will receive a tax cut of $1,087. The 44,584 Tennesseans in the First District who utilize the child tax credit will see that credit increase from $1,000 to $1,600 per child, and roughly 18,255 full-time equivalent jobs will be added to Tennessee’s economy.”

While the bill does a lot of good things, Roe said no bill is perfect, and there is no way to please everyone.

“I’m sure there are some people out there who won’t like it, but for the majority of people in the First District this is a winner,” Roe said. “I think it helps the vast majority of the First District. I think it will help them to keep more of their paychecks.”

“Republicans in Congress promised to work with President Trump to cut taxes for people of all income levels, and I’m proud the Tax Cuts and Jobs Act will deliver on this promise,” he added.

The U.S. Senate is currently still debating their version of the bill, which has some differences from the one passed on Thursday by the House. If the Senate bill passes the two bills will then be taken to conference where the differences will be ironed out, Roe said.