State makes changes to property tax relief program eligibility

Published 5:12 pm Friday, August 3, 2018

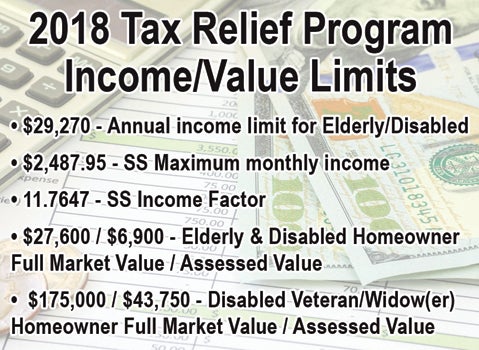

- Elizabethton Star Graphic / Data compiled from the Tennessee Comptroller of the Treasury.

Local officials underwent a training seminar this week to get updates on the state’s Property Tax Relief Program, and among the changes for the coming year is a slight increase to the income threshold for program eligibility.

“The income limit went from $29,180 to $29,270,” said Carter County Trustee Randall Lewis. “It increased by $90.”

To calculate eligibility for the program, Lewis said the state uses the homeowner’s 2017 income to determine eligibility to participate in the program for 2018.

The Property Tax Relief Program provides vouchers to eligible elderly, disabled, disabled veterans, and the widows and widowers of disabled veterans to assist them in paying their property taxes.

At the state level, the program is administered through the Tennessee Comptroller of the Treasury while the county’s portion of the program is operated through the County Trustee’s office.

The amount of tax relief assistance offered through the program is calculated from a formula using the county’s property tax rate, the assessed value of the property, and the income of the homeowner.

For this coming tax year, 2017 calendar year income must be at or below $29,270 for homeowners to be eligible with a maximum social security monthly income of $2,487.

The Tax Relief Program offers different value limits depending on whether a homeowner qualifies under the elderly and disabled portion of the eligibility or under the disabled veteran/widow(er) of a disabled veteran portion.

For those qualifying as elderly/disabled, a value limit of $27,600 of Full Market value (equal to $6,900 in assessed value) is covered by the program. Those qualifying as disabled veterans or the widow(er) of a disabled veteran have a Full Market value limit of $175,000 (equal to an assessed value of $43,750).

One other major change to the program this year involves homeowners who are staying in nursing homes.

Last year, the state had the Trustee’s Office send out final payment notices to nursing home residents informing them they would not be eligible to participate in the program this year.

“They went back and changed that,” said Gloria Colbaugh of the Carter County Trustee’s Office. “Those individuals will now receive a tax credit voucher.” That voucher will be applied to most nursing home residents, Colbaugh added.

The state has not yet set the tax relief allocation for Carter County, according to Lewis. The county’s portion of the tax relief has been set at $40 for each eligible property owner.